After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

PwC: SVOD spend to rise amid ‘major changes’ in viewing habits

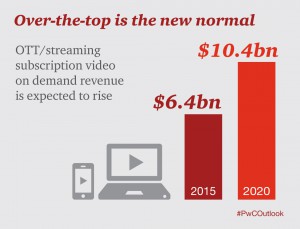

US over-the-top and subscription video-on-demand revenues are set to rise substantially in the next five years amid “major changes for how people watch TV and video,” according to PwC.

US over-the-top and subscription video-on-demand revenues are set to rise substantially in the next five years amid “major changes for how people watch TV and video,” according to PwC.

PwC’s ‘Global entertainment and media outlook 2016-2020: US edition’ claims that SVOD revenue will climb from US$6.4 billion in 2015 to US$10.4 billion in 2020.

The 2015-2020 compound annual growth rate for subscription VOD will be 10%, for transactional VOD will be 8%, but for pay TV subscriptions will be 0%, according to the study.

“As consumer wants and expectations continue to change, so too does the TV and video industry. Today’s and tomorrow’s definition of what it means to be a ‘media company’ will continue to evolve, as companies – not just entertainment and media companies – invest in content and direct customer media relationships,” said PwC.

“We will continue to see a rapid increase in new entrants and competitors in the space as subscriber-based businesses continue to consolidate. Operators are also attempting to target cord-cutters and cord-nevers by marketing their OTT streaming and download services – two areas that will represent tremendous growth potential for this industry’s foreseeable future.

PwC estimates that overall TV and video revenue will rise from US$121.4 billion to $124.2 billion in 2020, marking 0.5% CAGR, but noted that the continued growth of VOD and OTT services is putting pressure on the ‘theatrical window’ period traditionally enjoyed by cinemas.

In total, US entertainment and media spend – across all categories, including music, video games and publishing – is tipped to grow from US$603 billion in 2015 to US$720 billion by 2020.