CEE Survey: The big picture

Central and eastern Europe has been hit by the economic ill-winds blowing in from the Eurozone but pay TV remains surprisingly vibrant. Stuart Thomson looks at the numbers.

Central and eastern Europe has been hit by the economic ill-winds blowing in from the Eurozone but pay TV remains surprisingly vibrant. Stuart Thomson looks at the numbers.

The central and eastern European pay TV market has been buffeted by the ill winds blowing in from the Eurozone of late. The TV advertising market has suffered significantly in this environment, but pay TV has proved to be resilient – particularly in Russia, where DTH service Tricolor TV has continued to see strong growth.

DTH across the region is still booming. Intense price competition in certain markets has not prevented satellite being seen as a premium product that attracts users in a relatively high income bracket. As is the case with cable, satellite TV distribution remains characterised by a much larger number of players than in the more mature markets of western Europe.

Given the fragmentation of the market, it is perhaps unsurprising that a number of players have been consolidated – such as the merged Cyfra+ and n in Poland, and Slovak Telecom’s acquisition of Digi Slovakia – or, in some cases, ceased to trade. The latest satellite operator to join the list of casualties was Satellite BG in Bulgaria, a relatively small player in a highly competitive market that fell victim to the impact of the economic crisis. Satellite BG advised its former customers to sign up to the pay TV offering of telco Vivacom, one of a number of players across the region that has launched a satellite TV service as part of a strategy of providing bundled offerings of fixed and mobile telephone, data and video in order to capture market share and fend off rivals.

Elsewhere in the region, the Czech Republic has seen the consolidation of Skylink and CS Link, both owned by Luxembourg-based M7 Group, into a single ownership structure, although both brands continue to exist independently. Liberty Global/UPC DTH has meanwhile rebranded its satellite offering in the Czech Republic and Slovakia as FreeSAT, with 100,000 subscribers in late 2012.

In Hungary, UPC DTH continues to operate under the UPC Direct brand, competing with the likes of Magyar Telekom, which operates satellite, IP and cable TV services, as well as non-satellite service providers including cable operators and the Antenna Hungária-owned MinDig TV digital-terrestrial offering.

Consolidation has also been on the cards across the western Balkans, where Serbian cable leader SBB, Telemach Slovenia, Telemach BiH in Bosnia-Herzegovina, satellite operator Total TV and 15 smaller companies began operating as United Group from the beginning of May.

The group, which is majority-owned by Mid Europa Partners and the European Bank for Reconstruction and Development, plans to develop a series of joint initiatives for customers across the region’s borders, the first of which, free fixed phone calls between SBB, Telemach Slovenia and Telemach BiH customers, has already gone live. In Croatia, meanwhile, Telekom Austria-backed Vipnet has already begun consolidating the small cable sector as well as acquiring formerly RCS & RDS-owned satellite offering Digi TV and former SBB-owned Total TV to compete more effectively with Deutsche Telekom-backed T-Hrvatski Telekom, which offers its MAXtv service both via IPTV and satellite.

Despite the challenges, new standalone satellite TV offerings continue to launch across the region, such as the Ukraine’s Xtra TV and, most recently, ultra low-cost operator Freesat in Romania, which appears to be attempting to replicate the Tricolor TV model of providing a number of channels for a small annual fee, in this case RON99 (?23), and the purchase of a conditional access smartcard.

Russia and Ukraine

Over 30 million homes in Russia are believed to have taken pay TV services at the end of last year, with the vast majority that signed up for satellite services last year subscribing to Tricolor TV’s service. According to Informa Telecoms & Media research, two in five Russians nevertheless still rely on analogue terrestrial TV, although digital-terrestrial TV is gaining momentum. Russian cable operators on the other hand have yet to make much progress with digitisation, with only about one in 10 of Russia’s 11.4 million cable homes digitised at the end of 2012, according to Informa’s calculations. About two in five Russian homes take some form of pay TV service, leaving room for growth. Tricolor has over the last few years enervated the Russian pay landscape with its low cost offering, supplemented by a higher ARPU HD tier. The company has set an ambitious target of 16 million subscribers by the end of 2015, while growing its HD base from about a million to seven million by the end of next year.

Of Russia’s other main pay TV players, Rostelecom had about 6.6 million subscribers at the end of last year, following its 2011 acquisition of National Telecommunications, which gave it a strong presence in Moscow and St Petersburg. The other main players are MTS, ER-Telecom, Akado and TKT, with smaller operators including IPTV provider VimpelCom and satellite pay TV providers NTV-Plus and Orion Express.

Neighbouring Ukraine has a lower rate of pay TV penetration than Russia, with just over a fifth of households having signed up to date. High rates of piracy and the prevalence of free-to-air services have made pay TV a challenge.

About a quarter of TV homes took a digital service at he end of last year. The Ukrainian government has set a digital switchover date in mid-2015.

About a quarter of TV homes took a digital service at he end of last year. The Ukrainian government has set a digital switchover date in mid-2015.

Volia is the leading cable operator and has embarked on a process of attempting to consolidate the highly fragmented cable sector, with about 600 operators of various sizes active across the country. Volia launched Smart HD, an over-the-top offering that will be launched on third-party partner networks as well as its own network, in a move that could serve to boost the sector by offering an integrated TV offering across multiple operators.

Satellite TV is led by Modern Times Group’s Viasat Ukraine, with other players including Lybid TV and Xtra TV. However, Informa estimates that pay digital satellite accounted for only 2% of TV households at the end of last year. Digital cable accounted for 1.2 million homes compared with 2.3 million analogue cable homes. IPTV remains negligible. Leading telco Ukrtelecom has now been acquired – subject to regulatory approval – by SCM Group, owned by leading Ukrainian tycoon Rinat Akhmetov.

Poland

Within the European Union, Poland and Romania are the most sizeable markets and both have vibrant pay TV landscapes.

Poland, where pay TV penetration approaches 80%, has seen moves towards consolidation of its hitherto vibrant satellite TV sector, most notably in the merging of the Cyfra Plus and TVN-backed ‘n’ offerings to create nc+, which had 2.5 million customers at launch. The practices of the new platform attracted strong criticism and a government fine, which led to the operator apologising to its customers and ceasing its initial practice of automatically migrating subscribers to a default package of nc+ channels. Rival pay platform Cyfrowy Polsat has seen growth in subscriber numbers tail off, with its 3.56 million total at the end of March flat year-on-year. Nevertheless, Cyfrowy Polsat managed to grow its ARPU by 4.7% year-on-year. Orange’s Polish TV offering meanwhile had attracted 700,000 customers by the end of March.

The cable sector, including leading operators Multimedia Polska, UPC Polska, Vectra, Inea and Toya, collectively accounts for about four and a half million homes. There have been some shifts in ownership and moves towards consolidation in the sector, but it remain fragmented by western European standards. Multimedia Polska ended 2012 with just over one million customers, including 272,000 digital TV customers. Vectra meanwhile ended March with 813,000 subscribers, including 405,000 digital subs.

In April, private equity group Warburg Pincus has, via an affiliate, become a strategic minority investor in Polish cable operator Inea and plans to provide funding for a major fibre-to-the-home-based network expansion. Warburg Pincus said it believed the deal is the largest private equity investment in Poland so far this year. The funding will be used to support an expansion of the operator’s next-generation network, which provides bundled services to customers across the regions in which Inea is active. Specifically, Warburg Pincus will support Inea’s rollout of a FTTH-based network to bring high-speed broadband access to over 200,000 additional households and a significant number of businesses in its home territory of the Wielkopolska region in western-central Poland. According to Warburg Pincus the network, once completed, will be the most advanced in Poland, providing high-speed broadband access to over 500,000 homes across the region.

Meanwhile, UPC Polska, which acquired fellow operator Aster from Mid Europa Partners in 2011, this year sold some of the latter’s networks in Warsaw and Krakow to IPTV provider Netia, a condition of the acquisition.

Poland has also seen the growth of a number of over-the-top offebrings, led by Cyfrowy Polsat-backed ipla, which 3.2 million users in March, ahead of rival Onet.pl with 2.8 million.

Romania

In Romania over 70% of homes took a pay TV service at the end of last year.

Within the cable sector, RCS & RDS is the leading player, with over half of all pay TV subscriptions. RCS & RDS has also been active in other markets in the region under the Digi brand, but recently sold its Slovakian operation to Slovak Telekom, part of the Deutsche Telekom group. The Romanian market has been hit by the economic crisis, with the advertising market falling and intense price competition between pay TV operators.

Informa estimated that digital cable accounted for just over 1.2 million homes at the end of 2012, with about 2.3 million analogue cable homes and 2.3 million pay digital satellite homes. According to figures released by regulator ANCOM in May, Romanian TV retransmission services including cable, satellite and IPTV systems served over six million homes, representing total household penetration of over 85%, at the end of 2012. Cable networks grew 6.4% year-on-year to 3.8 million subscribers, with cable penetration now standing at 53.6%. DTH grew by 2.3% to 2.19 million, a recovery from the fall in numbers recorded in 2011, and IPTV grew by 34% to 37,000. The number of subscribers to all networks was 5% up year-on-year.

Cable is dominant in the urban areas that account for 61% of all subscribers, with 80% of homes in these areas using cable to receive TV. In rural areas, 63% of homes subscribe to DTH networks. Digital cable subscribers grew by 40% to 1.24 million, or a third of all cable subscribers. Overall, Romania had 3.4 million digital TV homes at the end of 2012, up 13.4%, with satellite networks accounting for 63% of digital homes. RCS & RDS had just over three million pay TV customers at the end of 2012, with over two thirds being cable homes and the balance taking its DTH offering. Romtelecom had about one and a quarter million pay customers, with the vast majority taking its satellite offering and a smaller group taking its IPTV offering. UPC Romania came third, with just under 1.2 million pay TV homes, including 320,000 satellite homes.

The DTH market, which had appeared to be consolidating after the acquisition of Boom TV by Romtelecom in 2011, has now seen the launch of a new, very low-cost offering called Freesat, and another launch by Orange. There has already been intense price competition between Romtelecom and RCS & RDS, with the former attracting a significant number of new subscribers to its satellite offering.

Overall, the central and eastern European pay TV market remains highly competitive, with over 50 DTH services having launched to date and a very large number of fixed line cable providers as well as a number of telcos that provide TV services both via IP and via satellite.

Revenues per user have been in decline through competition and bundling, and consumers have a large number of choices that enables them to get value for money when choosing their pay TV provider.

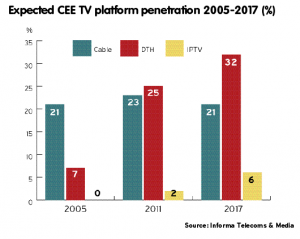

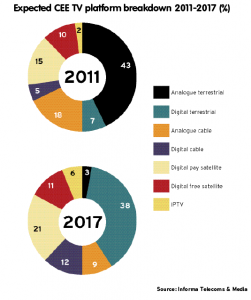

Despite challenges in upselling consumers and delays in establishing digital-terrestrial platforms, digitisation has made progress, with close to half of homes across the region receiving digital services by the end of 2012. Cable operators have introduced advanced services including video-on-demand, HDTV and DVR to combat churn.

The region has also seen an upsurge in over-the-top service providers, particularly in Russia and Poland. Some services have been launched by existing cable and pay TV players as a way of combating pure-play OTT services as well as to offer added value services to subscribers.

Despite near-saturation in a few key markets, prospects for pay TV growth across the region as a whole remain strong, particularly in relatively underserved markets including the two largest – Russia and Ukraine.