Subscription TV in decline as digital makes gains, says PwC

US subscription TV penetration is expected to fall from 79.5% in 2012 to 76.9% in 2016, thanks in part to over-the-top video services, according to PricewaterhouseCoopers (PwC).

US subscription TV penetration is expected to fall from 79.5% in 2012 to 76.9% in 2016, thanks in part to over-the-top video services, according to PricewaterhouseCoopers (PwC).

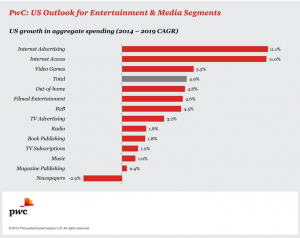

PwC’s Global Entertainment and Media Outlook 2015-2019 report says that US internet advertising is expected to continue to “outperform all other entertainment and media segments”, with double-digit gains of 11.1% compound annual growth rate (CAGR) expected.

This compares in the US to 3.2% CAGR for TV advertising, 1.2% CAGR for TV subscriptions and 1% CAGR for consumer magazine publishing. Spending on newspaper publishing is expected to “decline moderately” by 2.9%.

“Amidst the proliferation of content and access options, it’s clear that consumers are demanding more flexibility, freedom and convenience regarding when and how they consume content,” said Joe Atkinson, PwC’s US advisory entertainment, media and communications leader.

“They want it on-demand, on mobile and are readily engaging with content experiences that they can’t get elsewhere. This has re-energised the enduring appeal of shared, real-life experiences, such as cinema and live sport and music events, which has survived during the growth of digital.

“In creating new offerings, entertainment and media businesses will need to consider attributes that combine an outstanding user experience, attractive content assortment, smart discovery and a connected social community delivered through an intuitive interface that offers increased personalisation and access across devices.”

PwC said that total worldwide entertainment and media revenues will rise at a CAGR of 5.1% over the coming five years, from US$1.74 trillion in 2014 to US$2.23 trillion in 2019.

“The clear direction of travel is toward digital—a fact underlined by Internet advertising’s position as the fastest-growing segment of advertising through to 2019, overtaking global broadcast TV advertising. By that year, digital advertising as a whole – including digital out-of-home – will account for 38.7% of total global advertising revenue, up from just 16.6% in 2010,” said PwC.