DTVE Data Weekly: Online video continues to grow in Eastern Europe

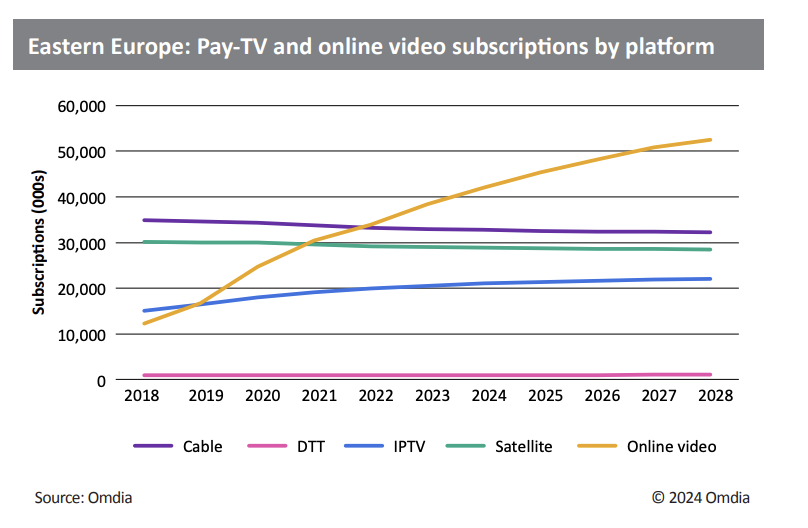

For the first time, online video is the largest individual viewing platform in Eastern Europe in terms of the number of subscriptions. Omdia’s most recent full-year data (2022), shows there were almost 34m online video subscriptions, compared to just over 33.2m cable subscriptions.

Source: Omdia

The 2022 launches of new online video services, such as Disney+ and SkyShowtime, in markets across the region pushed online video subscriptions to new highs in 2022 and beyond. Cable and satellite subscriptions declined YoY by 1.7% and 1.3%, respectively, and—as of late 2023—have continued to fall, a trend Omdia expects will continue through the forecast period. Subscriptions to pay DTT platforms will remain largely flat at around 1m through the end of the forecast period. IPTV remains the fastest-growing pay-TV platform, with subscriptions increasing by 4.4% in 2022 to just under 20m. Growth in IPTV will decline in the coming years as markets reach saturation, meaning that total IPTV subscriptions will be just over 22m by 2028.

Pay TV’s resilience in Eastern Europe

Despite the growth in online video subscriptions and minor declines in pay-TV subscriptions, total video market subscription revenue dropped by 3% from $9.03bn in 2021 to $8.77bn. However, the weakening of the euro and other Eastern European currencies against the US dollar throughout 2022 has affected YoY revenue changes, resulting in apparent weaker revenue growth when presented in US dollars instead of the local currency. In early 2022, the recovery of local economies was a high priority for many European countries after periods of lockdown during the COVID-19 pandemic. Russia’s invasion of Ukraine in February hindered the chances of recovery as inflation was driven upward, and the cost of food and energy increased amid concerns about supply chains and the potential exacerbation of geopolitical tensions in the region.

Partnerships between pay-TV operators and streaming services remain important in the region and benefit both parties. Pay-TV companies in Europe were able to observe the early impact of cord-cutting and streaming’s advent in the US and offer their subscribers the option to add streaming services to their pay-TV packages so as not to lose them altogether.

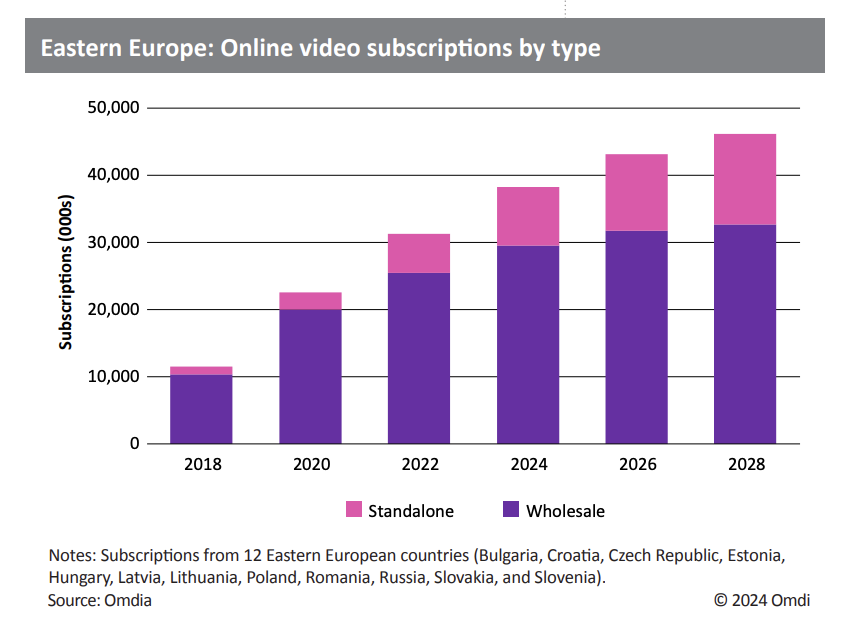

Online video operators get more exposure to their services amid an increasingly competitive space as their services are put in front of consumers who are already paying for their television content. In 2018, just 10.3% of online video subscriptions in 12 major Eastern European markets were indirect wholesale subscriptions sold via a pay-TV operator. That share had risen to almost 19% in 2022 and will continue to grow throughout the forecast period to nearly 30% in 2028. Furthermore, the cost difference between pay TV packages and online video services is much lower than in other regions, meaning there is less incentive to cancel a pay-TV subscription in favour of an online video one and, therefore, less of the cord-cutting trend seen in the US.

Streaming Expansion

Streaming’s continuous upward trajectory hit a speed bump in April 2022, when Netflix reported a decline in its quarter-end subscription count for the first time in a decade. The streamer’s subscription count dropped from 221.8m to 21.6m at the end of 1Q22, a decline of just 203,000 subscribers that was predominantly driven by the loss of 700,000 subscribers after the company suspended its operations in Russia.

The company also managed to turn the larger drop of 970,000 subscribers at the end of 2Q22 into a positive by beating its own forecast of a net loss of 2m subscriptions. Netflix ultimately ended 2022 with more subscribers than it had at the end of 2021.

The industry had been pondering just how high streaming could climb, and Netflix’s blip indicated that the market was closer to its ceiling than some had thought. With newer streaming entrants still developing their offerings and expanding their reach, the subscriber growth targets set by company leaders suddenly looked more ambitious than before.

Source: Omdia

Many streamers have moved into Eastern European markets in recent years as part of their ongoing global rollouts, but now that companies are no longer chasing new subscribers at any and all costs, cutbacks are being made to improve streaming’s bottom line. Having launched in much of Western Europe in 2020, Disney+ rolled out across most of Eastern Europe in June 2022.

Since then, the company has made several rounds of layoffs as it seeks to find $5.5bn in cost savings. Warner Bros. Discovery’s HBO Max launched in Eastern Europe in March 2022, replacing the company’s existing HBO GO service in many markets. A few months later, the company announced it was ceasing the commissioning of original productions in Europe as part of a drive to find $3bn in cost savings, a target which it has since increased to over $5bn.

Ambitions for SkyShowtime, a joint venture between Comcast and Paramount Global, may be less affected due to its primarily Eastern European focus. This nascent streamer picked up the rights to 21 European original HBO Max series, including some that had never launched on the Warner Bros. Discovery-operated service. Netflix now has a more permanent presence in Eastern Europe, having opened an office in Warsaw, Poland, in 2022.

Viaplay

With 7.3m paid subscriptions at year-end 2022, Viaplay’s largest market remains the domestic Nordic region (4.2m subscriptions, or 58% of its total). Poland is currently the second-largest individual market for Viaplay after Sweden. The service launched in August 2021, focusing on exclusive sports rights and a traditional entertainment offering. Here, Viaplay launched a series of operator bundling partnerships, including with T-Mobile, Play, and UPC. Before launching in Poland, Viaplay also reentered the three Baltic markets of Estonia, Latvia, and Lithuania (in March 2021).

More recently, however, Viaplay announced a review of its operations following a loss of more than 1m subscribers in 2Q23. Despite reporting an increase in subscriptions in Poland in 2Q23, Viaplay Group has stated that the company will “downsize, partner, or exit” from markets including the Baltics and Poland, along with its other international markets, the UK, the US, and Canada. The company cited the cost-of-living crisis, the high cost of content (particularly sports), and higher churn than expected in the wake of service price increases. Despite its subscriber growth through 2021 and 2022, Viaplay’s recent struggles highlight the growing pressure for streamers to deliver profits and demonstrate that streaming has a viable future and is not just a short-lived market disruptor.

Growing FAST market

One of the major trends in 2022 was the emergence of FAST services, which are free-to-access platforms that feature curated online channels predominantly with long-running library content. As they are distributed over digital networks, these services can generate revenue through targeted advertising. Due to Eastern Europe’s smaller market size, FAST channel operators have yet to launch in the region, with some citing the costs needed to dub predominantly English-language content into different languages as a current stumbling block in the process. Revenue from FAST in Eastern Europe stood at $23.5m in 2022 and is set to increase by 78% to reach $41.9m in 2028. It will, however, only account for a minimal amount of total regional revenue, significantly behind pay-TV and online video subscription revenue throughout the forecast period.

Matthew Evenson is Omdia’s Research Analyst, TV & Online Video