After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Ovum: Telcos have made inroads into re-bundling, but complacency is not an option

Last year was the year operators finally listened to consumer demands: we want new “sexy” bundles, and we will just buy Netflix-like services à la carte if we don’t get them.

Last year was the year operators finally listened to consumer demands: we want new “sexy” bundles, and we will just buy Netflix-like services à la carte if we don’t get them.

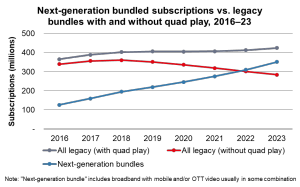

Ovum’s new bundling forecasts (that all include fixed broadband as a service) estimate that subscriptions to next-generation bundles will make up almost 41% (356 million) of total bundled subscriptions by 2023. The most prominent next-generation bundle is expected to be fixed broadband with mobile, followed by broadband and pay TV. Ovum predicts that subscriptions to the first bundle will make up 38% of all next-generation bundle subscriptions and 15% of total bundled subscriptions by 2023.

In contrast, legacy dual/triple-play bundles (the most well-known being fixed broadband and fixed voice, possibly with pay TV as the third element) are losing traction and are forecast to shrink from 50% of bundled subscriptions in 2018 to 32% by 2023. But the so-called legacy quad-play bundle – that includes a smartphone bundled alongside fixed voice and pay TV in the fixed broadband bundle – has some legs left. If we count this as a “legacy bundle,” then Ovum expects to see slight growth in overall legacy bundles (see Figure 1).

Operators have traditionally been slow to adjust their products to fresher ones. A few years back, one Asian telco said it would love to introduce new bundles, but legacy OSS and BSS couldn’t cope. Today, that seems to be less the case. Rather, we see some telcos moving quite fast to trying and testing new bundles.

Operators have traditionally been slow to adjust their products to fresher ones. A few years back, one Asian telco said it would love to introduce new bundles, but legacy OSS and BSS couldn’t cope. Today, that seems to be less the case. Rather, we see some telcos moving quite fast to trying and testing new bundles.

Bundle marketing is still patchy. In some cases, these new bundles later “disappear” from the operator’s main landing webpage for bundles (presumably because they weren’t a hit after several months). But one telco told Ovum that even though a bundle (in this case, fixed broadband with pay TV) no longer appeared on the main webpage, this did not mean the consumer couldn’t buy that bundle. Another telco said the marketing of an older bundle type (in this case, broadband with fixed voice and pay TV) had merely shifted to a different part of the operator’s website (which this author couldn’t locate!). For consumers, getting a clear view of what’s available and what’s not can get confusing. We doubt whether most understand that their existing bundle could still be available even if it’s no longer advertised. In short, operators should have a reference to every bundle that’s on offer, or consumers won’t know whether their preferred bundle is still around.

Keeping to this theme, Ovum believes the marketing of bundles is about to become more complicated. Several operators (particularly in Asia) are wrapping quirky goods (e.g., a Dyson vacuum cleaner, air/water purifiers, etc.) or non-telco services (e.g., power and gas) around the traditional telecoms bundle that has been discussed here. One leading Asian telco has an extensive hard copy folder of quirky bundles, which customers to the retail shop can browse. While we are not against operators taking on the role of de facto retailer where it makes sense, we do caution that all things bundling need to be kept simple for consumers. Anecdotally, we know of one case where a consumer (in Taiwan) measured the cost of a luxury good being bundled with telco services, only to conclude the bundle made absolutely no financial sense – and that simply is not smart bundling.

Nicole McCormick is practice leader, broadband and multiplay at Ovum.

Straight Talk is a weekly briefing from the desk of the Chief Research Officer. To receive this newsletter by email, please contact us.