Paramount Global and Pluto TV drives FAST growth in the US

Source: Pluto TV

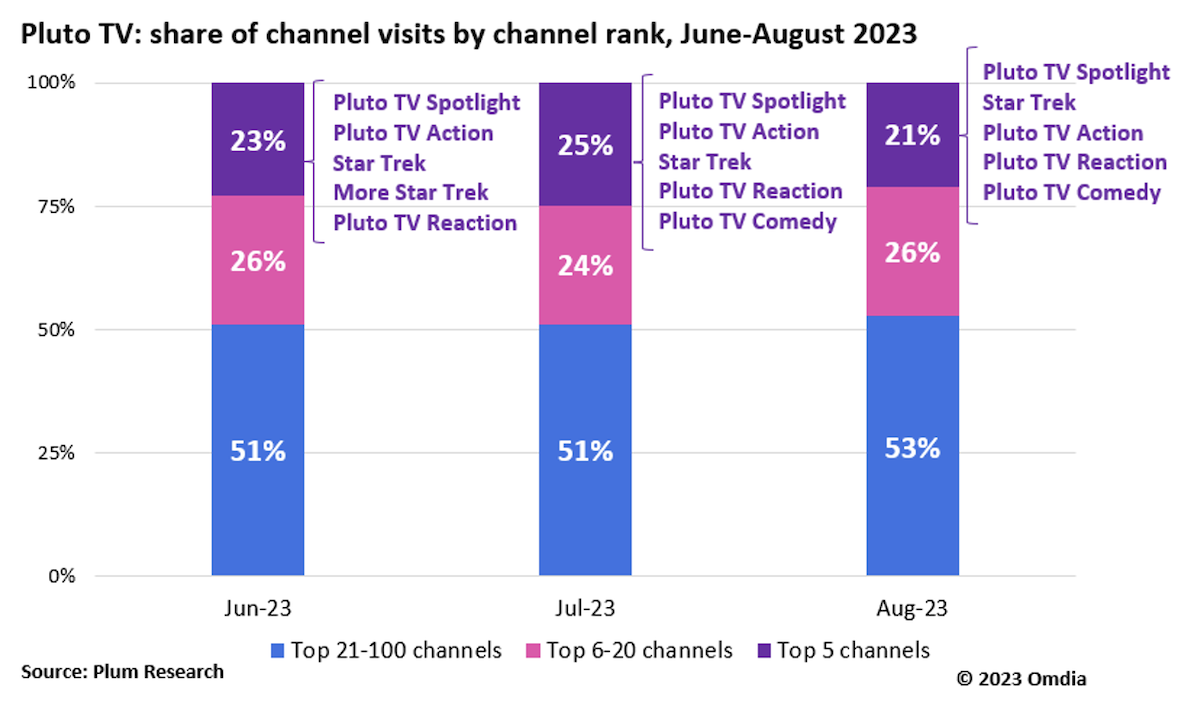

Free Ad-Supported Television (FAST)’s growth in the US is being powered by a small number of players with the top five channels accounting for more than 20% of monthly consumption, according to exclusive analysis seen by DTVE.

FAST has become one of the most discussed growth opportunities over the past three years in the US, but exclusive research from TBI sibling Omdia in partnership with PlumResearch has pointed to the huge reach of a handful of channels.

While the overall number of FAST channels in the US is still growing, data suggests Paramount Global and its Pluto TV division have staked a considerable claim on audiences with the top five US channels all owned by the studio.

Pluto TV Spotlight, Star Trek, Pluto TV Action, Pluto TV Reaction and Pluto TV Comedy accounted for 21% of consumption across the top 100 FAST channels in the US in August, while the top 20 channels accounted for around half of all FAST visits in that month.

Pluto TV and Paramount-owned FAST channels also took the top five spots in the FAST consumption charts in June and July, with positioning on the EPG a key driver of popularity.

The channels also offer strong IP and elements of exclusivity which are fast becoming key to channel operators, according to Maria Rua Aguete, Omdia’s senior research director for media & entertainment.

“Content discoverability has become a vital tool for channel owners as the FAST ecosystem has mushroomed,” Rua Aguete tells TBI.

“Twenty channels now represent around 50% of FAST viewing in the US, so we are likely to see a lot more consolidation in future as the importance of offering strong IP – such as Star Trek – on an exclusive basis grows.”

FAST channel expansion

More broadly, the rapid expansion of the FAST landscape shows little sign of slowing, with the number of US channels rising between Q1 and Q3 again.

The US channel count rose from 1,539 in Q1 2023 to more than 1,600 in Q3, with the increase largely driven by Plex’s offering rising from just under 500 channels at the start of the year to more than 750 in the latest quarter.

While Plex’s offering has risen considerably, Omdia’s Digital Content & Channels Intelligence Report highlights that many channel carriers are slowing expansion, with LG Channels reducing its overall count.

Major players including Pluto TV, Roku TV, Tubi and Vizio increased their FAST offerings but only by single digit percentages, while Amazon’s Freevee, Samsung TV Plus and Sling Freestream ramped up offerings by adding 152, 73 and 176 net channels respectively.