After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Netflix tops list of streaming ‘essentials’ but Apple TV+ and Peacock trail

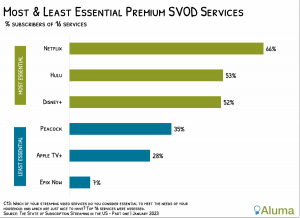

Netflix, Disney+ and Hulu are considered ‘essential’ subscriptions by over half of their customers, while other leading US streamers fall under this bar, according to research by Aluma Insights.

Based on a survey of 1,947 US streaming customers, Netflix, Hulu, and Disney+ topped the essentials list, while Epix Now. Apple TV+ and Peacock came at the bottom of the list of the top-16 streamers in the market.

Based on a survey of 1,947 US streaming customers, Netflix, Hulu, and Disney+ topped the essentials list, while Epix Now. Apple TV+ and Peacock came at the bottom of the list of the top-16 streamers in the market.

Netflix topped the list, being considered essential rather ‘nice to have’ by two thirds of its subscribers. Hulu and Disney+ scored 53% and 52% respectively.

According to the research outfit, the results suggest that Disney boss Bob Iger’s contention that raising the price of its ad-free option caused minimal losses is convincing, while Comcast’s plans for Peacock may be flawed.

Aluma expects both Disney+ and Hulu standalone prices will increase by around 15% during 2023.

Aluma says the results suggest Comcast plan to eliminate Peacock’s service’s free ad-supported tier and phase out a complimentary service for Xfinity subscribers, an audience the company estimates accounts for at least 70% of customers, may be fraught with risk.

While Apple TV+ has high-quality originals, meanwhile, Aluma speculates that its lack of third-party content in depth may be a problem.

One risk to less-essential services is plateauing monthly SVOD spending. Aluma found that in 2022 SVOD households spent on average US$43.25 per month on the services, up significantly from 2020 but mostly stable compared with 2021. However, between 2020 and 2022, the percentage of SVOD buyers open to spending more declined from 14% to 8%, while the percentage who planning to reduce these expenses increased from 17% to 25%.

“This is a one way of comparing a service’s utility with that of its competitors. It says to some owners you’ve a bit more latitude when it comes to revenue optimization measures, such as cracking down on freeloading or increasing retail prices. It says to others there is great risk in significantly altering prices or service terms,” said Michael Greeson, founder of Aluma Insights.

“As buyers move closer to their SVOD spending limits, less essential services will have a difficult time optimizing revenue without enduring sizeable subscriber losses.”