After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Global TV and video service revenue to reach US$559bn in 2022

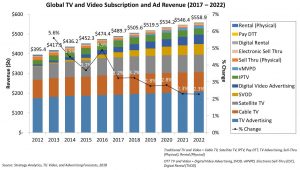

Consumer and advertising spend on TV and video services will grow 14% globally from US$490 billion in 2017 to US$559 billion (€491 billion) in 2022, with OTT video to account for 90% of this growth.

This is according to Strategy Analytics, which estimates that consumer spend and digital ad revenues for over-the-top video services will double over the forecast period to reach US$123 billion in 2022.

This is according to Strategy Analytics, which estimates that consumer spend and digital ad revenues for over-the-top video services will double over the forecast period to reach US$123 billion in 2022.

This forecast accounts for revenues from subscriptions, rentals, purchases and ads on services including Netflix, Amazon Prime Video, Now TV, Maxdome, Iflix, Hulu, DirecTV Now, YouTube, Facebook, iTunes and Google Play.

“OTT TV and video services will be the driving force behind future revenue. However, traditional TV and video services should not despair too much, as they will continue to account for the majority of consumer and advertising spend for the foreseeable future,” said Michael Goodman, director, television and media strategies, at Strategy Analytics.

The research firm’s ‘TV’s Transformation: A Unified TV and Video Market Perspective’ report estimates that consumer and ad spend on traditional TV and video services will account for nearly 78% of all TV and video revenue globally by 2022, passing the US$435 billion-mark.

North America is expected to remain the largest TV and video market in 2022, accounting for 38.7% of global consumer and advertising spend on TV and video, while Asia Pacific will account for 23.4%.

In Asia Pacific, consumer spend on legacy pay TV services are forecast to see “robust growth”. By contrast, consumer spend on legacy pay TV services are flat or declining in North America and Western Europe, though IPTV is expected to buck the cord-cutting trend in Western Europe.