Focus: AVOD on the rise

Streaming in general has grown hugely during 2020, including AVOD. Fateha Begum, associate director at DTVE sister research group OMDIA, explores the likely future development of ad-supported services.

Over the years, and particularly in early 2020, online video penetration increased as many households turned to such services for the first time.

Simultaneously, the average number of video subscriptions per household increased as consumers stacked multiple video services to meet their household’s content needs.

COVID fuels SVOD & AVOD gains

Despite the rise in paid subscriptions, consumers are also increasingly turning to free AVOD services for viewing. Omdia’s consumer surveys in November 2020 highlighted the growth in AVOD video consumption both in terms of number of services accessed and frequency of viewing.

Despite the rise in paid subscriptions, consumers are also increasingly turning to free AVOD services for viewing. Omdia’s consumer surveys in November 2020 highlighted the growth in AVOD video consumption both in terms of number of services accessed and frequency of viewing.

During the early heights of the pandemic, AVOD saw a considerable rise in viewing as consumers turned to a higher number of devices and services during stay-at-home orders.

The rise in AVOD however was not solely driven by Covid-19 as consumer surveys reveal increased viewing in the latter part of 2019 driven by developments in the ad-supported market, including new service launches.

AVOD’s place in a fast-evolving ecosystem

AVOD has seen significant growth in the past years as more native propositions launch in market and we see more partnerships and M&A activity, as well as greater geographic expansion.

More content owners are joining forces to compete with global giants such as Netflix and Prime Video, in both the ad-supported and subscription online video space. Video services are also seeking to expand their global footprint; this is particularly the case for English-, Spanish- and Hindi-language services, which have greater scope for international expansion.

As consumers move online, an opportunity arises for content owners to provide access to content away from the traditional TV model. The increase in subscription online video has paved the way for AVOD services as consumers understand the freemium proposition better, and are spending more online. Consumers’ understanding of watching ‘free’ content with adverts and the requirement of an incremental fee to access premium content or remove adverts has improved.

AVOD’s revenue raising potential & hybrid strategies

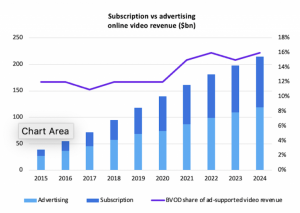

Global online video advertising revenues are expected to reach $74bn in 2020 and are projected to grow to almost $120bn in 2024, consistently generating more revenues than subscription video services.

As linear TV advertising revenues fall across many markets globally due to the rise of online video consumption, broadcasters have sought revenues by offering a ‘freemium’ content proposition online. Revenue is generated by incentivising consumers to pay a monthly fee to upgrade or via advertising revenues from lower tiers.

A hybrid AVOD-SVOD model will continue to grow in popularity for commercial broadcasters, particularly as broadcasters increasingly reserve content titles for their online platforms and are able to provide deep content libraries.

Broadcasters’ deep content archives allow them to provide thousands of hours of content to keep consumers engaged. While traditionally reliant on catch-up and archive content, Omdia expects new content acquisitions to be a key driver of AVOD usage going forward.

Broadcaster VOD’s (BVOD) share of total online video advertising revenues, however, had been in decline in recent years largely due to Facebook’s and Google’s duopoly in the market, although this is set to increase marginally.

Fateha Begum is associate director for Connected Devices & Media at OMDIA, the global research powerhouse which, like DTVE, is part of Informa. The excerpt above is from her recent reports titled ‘AVOD consumption behaviours’.