After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

Ovum: skinny bundles to drive US pay TV growth

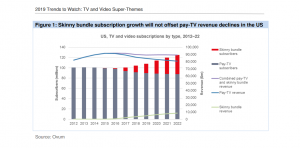

Next year will be the first year that ‘skinny bundles’ drive overall subscription growth across pay TV and OTT in the US, reversing a near-decade-long trend, according to Ovum.

The prediction is part of the research firm’s ‘2019 Trends to Watch: TV and Video Super-Themes’ report, which claims that skinny bundles will solve pay TV subscriber-growth issues but average revenue per-user (ARPU) will suffer.

The prediction is part of the research firm’s ‘2019 Trends to Watch: TV and Video Super-Themes’ report, which claims that skinny bundles will solve pay TV subscriber-growth issues but average revenue per-user (ARPU) will suffer.

Ovum predicts that there will be more over-the-top pay TV service launches in 2019, particularly outside the US, but warns that ARPU rates outside the US are much lower, meaning there is “less wiggle room for price cutting”.

“OTT pay TV is looking increasingly like a loss leader for adjacent businesses,” said report author and Ovum’s chief entertainment analyst, Ed Barton. “If this is the case, multiple withdrawals are likely from companies offering this deceptively challenging video business model, by the end of 2019.”

In the US, Ovum predicts that while there will be overall subscription growth from pay TV and skinny bundles, combined revenues will continue to decline to 2022 with the rise of the skinny bundle failing to offset pay TV declines.

“Skinny bundles are much less valuable in terms of both ARPU and commitment periods, meaning churn rates are markedly higher,” said Barton. “Paying carriage for enough recognisable channels to be competitive means that at sub-pay TV pricing levels, you are almost certainly teetering on a razor-thin-to-negative margin.”

On the content front, the report claims that the current wave of ‘megamergers’ in the media sector will concentrate content spending across fewer platforms that are owned by a handful of global giants.

“In 2019, more content investment will be focused on fewer platforms, as the supersized entities make big bets on direct-to-customer platforms to compete more effectively with Netflix and Amazon,” said Barton.

However, he predicted that combined companies like AT&T-Time Warner, Disney-Fox and Comcast-Sky will not be able to “meaningfully scale” more than one or two direct-to-consumer video platforms each, meaning original content spend will be concentrated on key services.

Finally, Ovum predicted that 2019 will be the year when it becomes clear whether partnerships will help broadcasters compete more effectively with digital giants like YouTube, Netflix, Amazon and Facebook.

Citing initiatives like Salto in France, 7TV in Germany and the rumoured ‘Kangaroo 2’ project in the UK, the report claims that broadcaster alliances may be able to attract bigger digital audiences, gather better data, and compete more effectively for digital advertising and subscription revenue – though it cautions that such strategies are at this point still unproven.