DTVE Data Weekly: Pay TV claws back some power

While the traditional pay-TV market has been significantly affected over the past decade by online video growth—and the cord-cutting trend associated with it—pay TV appears to have settled into a pattern that will see it continue to decline but at a progressively slower rate of decrease.

Some of the benefits of online video over pay TV are becoming less stark than they once were. Perhaps the key factor in online video’s success has been its low pricing. The streaming services launched at price points much lower than their pay-TV competitors, and it was this, combined with much more flexible monthly contract terms, that prompted the ensuing burst of online video adoption.But now, while the contract benefits remain, the price differential is becoming less of a factor, with the major online video services in the midst of applying some significant price increases.

Rising prices

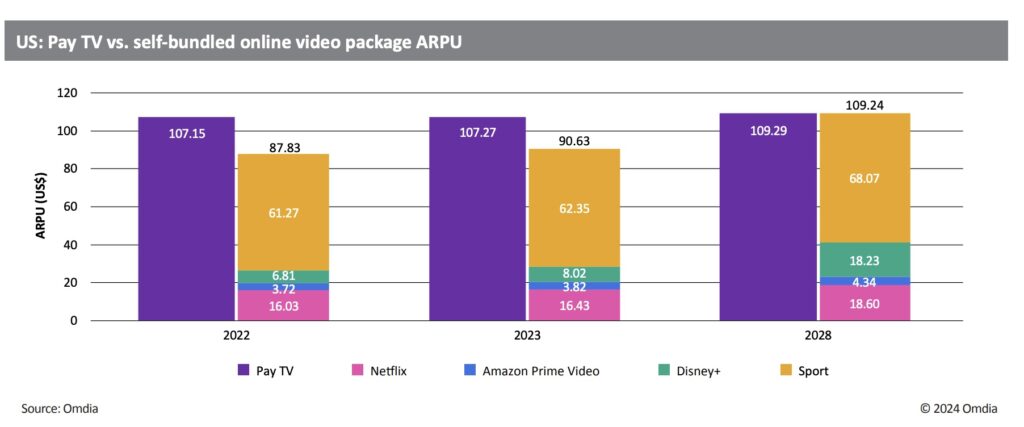

Taking the US, the world’s most expensive pay-TV market, as an example, the cost of self-bundling a pay-TV-like package that comprises the country’s top three general entertainment services (Netflix, Disney+, and Amazon Prime Video) plus a subscription to the leading sports streamers (MLB.TV, NBA League Pass, and YouTube NFL Sunday Ticket) was $87.83 in 2022—the equivalent of 82% of the average pay-TV ARPU. Omdia data shows that ongoing online video price increases will grow that percentage to 84.5% for 2023, and, assuming online video price increases continue at their current rate, the online video bundle total will catch up with pay TV in 2028 and overtake it thereafter. As the streamers continue to implement their profitability plans, characterised by higher prices, reducing amounts of exclusive premium content, the imposition of advertising, and a clampdown on password sharing, the positivity toward the services, built up in their formative years, will start to dwindle. This will make online video subscription bases more vulnerable to churn, a situation that starts to shift the power balance back toward pay TV.

During their meteoric rise, the steamers held sway, with pay-TV services needing to bundle their star quality into their own services to assist churn reduction. But now, with the streamer proposition not quite as compelling as it was, streamers will have more difficulty attracting direct subscriptions. This means they will grow more reliant for subscription growth on aggregation partnerships that give them access to the long-established subscription bases of pay-TV operators and telcos.

Pay TV has been regularly written off as a technology in terminal decline, but it continues to find ways to remain relevant, and Omdia’s forecasts highlight that it will be significant for many years to come.

Adam Thomas is Omdia’s senior principal analyst, TV & Online Video.