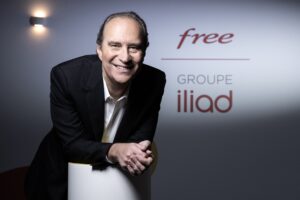

Xavier Niel’s Iliad in fresh bid to merge Italian operation with Vodafone

Xavier Niel (@Joel Saget/AFP; Source: Groupe Iliad)

Xavier Niel’s Iliad Group has made a fresh bid for the merger of its Italian operation with that of Vodafone, valuing Vodafone Italia at €10.45 billion and Iliad Itala at €4.45 billion.

The proposal, which comes two years after Vodafone rejected Iliad’s first offer for its Italian operation, would see both Iliad and Vodafone obtain 50% of the share capital of a new company. Vodafone would get a €6.5 billion cash payment and a €2.0 billion shareholder loan to ensure long-term alignment. Vodafone’s equity in NewCo at closing would be valued at €1.95 billion.

Iliad would come away with a €500 million cash payment and a €2.0 billion shareholder loan.

The merged business would be expected to generate €5.8 billion in revenule and €1.6 billion in EBITDAaL for the financial year ending March 2024. Iliad has identified €600 million annual synergies in capex and opex together.

Vodafone shares rose sharply this morning on news of the potential deal. Vodafone has previously said that it will review options for he Italian operation, and has reportedly been looking at a possible tie-up with Swisscom-owned Fastweb.

Regarding its latest offer, Iliad said that the combined company, dubbed NewCo, would be the the leading actor for investment in cutting-edge technology and customer-centric solutions in the Italian telecom market, supporting and accelerating the country’s digital transformation and especially fibre adoption.

The company added that the combined operator would benefit from Iliad’s approach to connectivity, affordability and digital inclusivity and Vodafone’s expertise in B2B services.

According to Iliad, based on Vodafone Italia’s estimated EBITDAaL of €1.34 billion for FY2024 (as per broker consensus), the proposed transaction implies an EBITDAaL multiple of 7.8x, i.e. more than the 7.1x EBITDAaL multiple offered by iliad in its €11.25 billion offer in February 2022. It provided an adjusted EBITDaL multiple of 10x.

Thomas Reynaud (©Joel Saget/AFP; Source: Groupe Iliad)

Iliad’s proposal gives it a call option on Vodafone’s stake in NewCo and the ability to acquire a block of 10% of of the NewCo share capital every year at a price per share equal to the equity value at closing, potentially generating up to €1.95 billion in additional cash for Vodafone.

Thomas Reynaud, iliad Group CEO, said: “The market context in Italy calls for the creation of the most innovative telecom challenger, with ability to compete and create value in a competitive environment. We believe that the profiles and complementary expertise of iliad and Vodafone in Italy would allow us to build a strong operator with the ability and financial strength to invest for the long term. NewCo would be fully committed to accelerating the country’s digital transformation and especially fiber adoption and 5G deployment, with more than €4 billon of investment planned over the next 5 years.”