After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

IHS: localised content as important as price in Indian video market

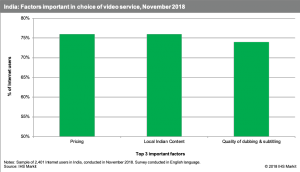

The three most important factors for consumers choosing video services in India are pricing, local Indian content, and quality dubbing and subtitling, according to IHS Markit.

The research firm said that “localised content is as important as price,” but added that out of all the markets it surveyed, Indian consumers were most likely to cite price as an important factor in their video service decisions.

The research firm said that “localised content is as important as price,” but added that out of all the markets it surveyed, Indian consumers were most likely to cite price as an important factor in their video service decisions.

In India, IHS estimates that the average revenue per user (ARPU) for pay TV is US$3.7 (USD) per month – with satellite pay TV services reaching an average of US$4 while local over-the top services cost less than US$1 per month on average. By comparison, Netflix’s basic monthly package is currently priced at around US$7 per month in India.

According to the research, online subscription services will grow faster than pay TV in India in the coming years but will still account for a much smaller share of the market.

Pay TV is expected to add 22 million subscriptions over the next five years to reach 188 million, while online video services are tipped to add 25 million subscriptions over the same period to exceed 35 million subscriptions by the end of 2022.

“While in the past couple of years global OTT companies increased their focus on the Indian video market, including investment in local content, they face fierce competition from India’s rich and well-established local OTT players,” said Fateha Begum, associate director, connected devices and media consumption, IHS Markit.

“India’s successful domestic film and network TV markets pose challenges for newcomers lacking the bulky local content libraries of their more entrenched local competitors. Despite launching its Sacred Games TV series in 2018, featuring Bollywood star Saif Ali Khan, Netflix still has a long way to go to grow its subscriber base in this large and diverse market.”

According to IHS stats, Star India’s 2016-launched Hotstar Premium subscription service will grow its Indian subscriber base by 60% in 2018, accounting for 25% of the market’s online video subscriptions – thanks to largely to its investments in premium sports, local-language content and international fare from the likes of HBO, Disney and Fox.

“The importance on localised content to Indian consumers highlights the prominence and success of India’s network TV and Bollywood content,” said Begum. “It also presents several hurdles global players must overcome in order to increase their subscriber bases in the market.”