Why is ad-supported video heading for the FAST lane?

Free ad-supported streaming TV (FAST) is generating an increasing amount of attention in the TV and video business. FAST channels offer numerous benefits to content owners, such as the option to monetize old and unused library content or to offer a new content bundle.

Earlier this year, Omdia released a new set of forecasts that quantified the global size of the FAST market, and our latest research carries out an even deeper dive to look more closely at a range of country-level data.

This new research estimates that FAST channels will generate global revenue of US$6.3 billion in 2023. As is to be expected, the US is the leading force, with FAST channels in the country generating more than 80% of the global figure throughout Omdia’s 2023–27 forecast period.

FAST beyond the US

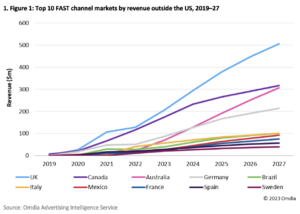

However, looking beyond the US, we are also forecasting that the UK, Canada, and Australia are all about to experience major spikes in FAST activity, leading to rapid expansion over the next four years. Though the US will continue to dominate the market, a US$1.6 billion revenue opportunity will emerge for FAST channels outside the US by 2027. Omdia research reveals that after the UK, Canada, and Australia will come Germany, Brazil, Italy, Mexico, France, Spain, and Sweden, and together these make up the top 10 non-US markets, all of them poised for impressive growth.

However, looking beyond the US, we are also forecasting that the UK, Canada, and Australia are all about to experience major spikes in FAST activity, leading to rapid expansion over the next four years. Though the US will continue to dominate the market, a US$1.6 billion revenue opportunity will emerge for FAST channels outside the US by 2027. Omdia research reveals that after the UK, Canada, and Australia will come Germany, Brazil, Italy, Mexico, France, Spain, and Sweden, and together these make up the top 10 non-US markets, all of them poised for impressive growth.

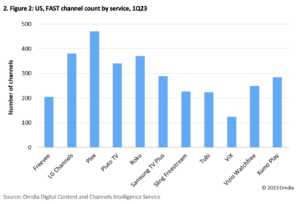

The US growth has been driven by a rapid increase in the number of FAST channels: more than 1,600 channels are already available in the US.

This growth is not necessarily all positive, however: overcrowding the market could make it difficult for some channels to gain visibility.

So bearing in mind the significant growth expected over the coming years, improving content discovery will be critical to the success of those channels.

The strong presence of device manufacturers in the FAST channel market is also noticeable. They have found that their activities offering advertising and services tend to be more profitable than their core hardware sales, so they are moving strongly into advertising and connected TV to make the most of these new revenue streams.

Although three of the five largest FAST markets are English-speaking nations, which benefit from the vast amounts of English-language content available from the US, there are also Canada, Germany, and Brazil in third, fourth, and fifth place respectively, which will also offer mainstream FAST opportunities on a significant scale for non-English content.

Although three of the five largest FAST markets are English-speaking nations, which benefit from the vast amounts of English-language content available from the US, there are also Canada, Germany, and Brazil in third, fourth, and fifth place respectively, which will also offer mainstream FAST opportunities on a significant scale for non-English content.

Omdia’s research has found that FAST revenue grew almost 20-fold between 2019 and 2022, and we are expecting it to triple between 2022 and 2027 to reach US$12 billion. Much of this growth will be driven by the US, and by 2027 the US FAST channel market will exceed US$10 billion in revenue. The UK and Canada, two of the countries that enjoy a significant overspill of content from the US, will have FAST markets worth more than US$500 million and US$300 million respectively by 2027.

Omdia forecasts that FAST channels in Germany will generate just over US$200 million in the same year, when those in Brazil will hit revenue of US$100 million, representing around half of the total Latin American FAST market, which will be worth US$207 million in 2027.

FAST revenue in Mexico will be US$93 million in 2027, making it the seventh-largest individual FAST market. Though US$12 billion in revenue for FAST channels in 2027 is an impressive figure, when this is viewed in the wider context of online video, it is social video that remains the hottest growth story for the next five years. FAST channels are another emerging window in which to monetize content but not the only one.

Maria Rua Aguete is senior research director, media and entertainment at Omdia.