After more than 40 years of operation, DTVE is closing its doors and our website will no longer be updated daily. Thank you for all of your support.

DTVE Data Weekly: Disney moves to one SVOD brand in Latin America

Key issues arise from Disney merging its two streaming brands in the Latin American region. Star content in Latin America was deployed quite differently than in other regions (e.g. in Europe). Most obviously, customers in Latin America had to pay for an additional service to watch such content: Star+.

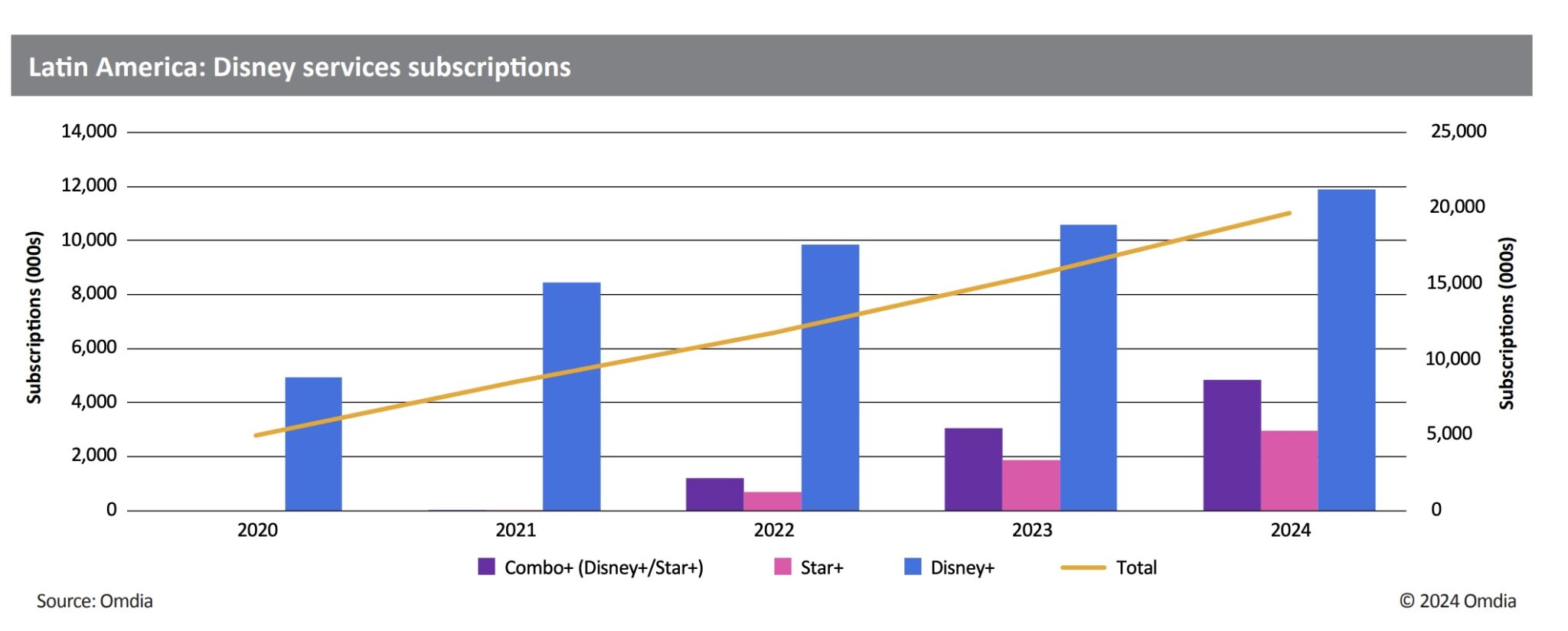

Source: Omdia

The main differentiator for the service was live sports, a great asset for Disney given its proprietary channels, ESPN and later Fox. This justified an extra fee because the sports content was not included in other regions. With time, Disney shut down its linear signals in favour of Star+. Given that the Fox brand is beloved in the region, having to access its content through Star+ was, and still is, tedious for consumers.

Disney employed a strategy to include the bundle through different service providers, including pay TV, mobile, and broadband. Other players, such as regional e-commerce giant Mercado Libre, have included it as part of their points rewards program, which later evolved into Meli+ in Brazil and Mexico.

Reportedly, Star+ did not do as well as expected during its first quarters after launch. This was due to licensing issues, dubbing unavailability, and pricing concerns. However, its strength from the beginning was providing access to all of ESPN’s proprietary content— but at the same time, this depended on expensive rights to international sports leagues.

Market Ranking

The SVOD market in Latin America is clearly dominated by Netflix, which by year-end 2023 was expected to have around 51% of total SVOD revenue, thanks to both its Standard with Ads tier and additional members’ plans. Disney comes second with 11% (both services and the bundle).

Paramount+ and (HBO) Max are in third and fourth place, respectively. The former experienced rapid growth in subscriptions over its first few quarters, mainly due to bundling with service providers, whilst the latter cleverly offered aggressive discounts at launch, including a permanent 50% off for newcomers.

Disney now believes the best way to grow its SVOD market share is to phase out the Star+ brand and adopt a strategy similar to the one in Europe by moving toward a single streaming brand under the Disney+ name. The merger will benefit consumers through improved usability of all assets in one service, including the key differentiator of live and other sports content (by including Star content in the same platform). However, a few factors must be considered:

- Cost: Merger costs will need to be considered, with a possible price increase after its conclusion.

Alternative plans: It is highly plausible that Disney+ could also introduce an ad tier to mitigate the price increase, likely below the current bundle price. - Number of users per account: The change would decrease the current number of users to seven, no matter what kind of content they prefer.

- Password sharing policies: There is a greater risk of this happening. An extra member policy like Netflix’s is a plausible option in terms of cost-effectiveness for customers.

Omdia views Disney’s decision as reasonable and expects the service to reach close to 20m subscriptions by the end of 2024. Apart from the obvious benefits of high-quality content, pricing is a key factor in Latin America. Should the company decide to apply an ad-supported plan, it has the potential to increase the reach of Star+ content greatly.

Juan Villegas, is Omdia’s research Analyst for media & entertainment