The sky’s the limit

The satellite industry has proven resilient against the backdrop of a global financial crisis. With revenues continuing to rise and new launches pending, Graham Pomphrey looks at how traditional services and new models are helping to drive the market.

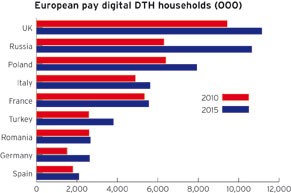

If proof were needed that the satellite industry is in a good state of health, SES Astra recently announced findings that, for the first time, the number of satellite homes had overtaken cable homes in Europe. The operator’s Satellite Monitor, covering 29 European and North African countries, found that satellite reaches 77 million households, six million more than cable . Of the 244 million TV homes in the region, around 60%, or 146 million, receive digital services.

The reason for the shift is pretty simple, according to Astra’s chief commercial officer Alexander Oudendijk. “The figures suggest that satellite television has significant advantages over cable in terms of reach, bandwidth, programme choice, costs and its ability to carry a large number of HD channels,” he says.

Perhaps an unsurprising response from a satellite operator. But Oudendijk points out that pretty much every area of Astra’s business is growing. In 2009, it broadcast to 125 million TV homes across Europe and North Africa – three million more than the previous year. “We expect that the launch of new channels, and the market entry or expansion of pan-regional pay-TV operators will lead to positive growth rates again this year,” says Oudendijk.

Perhaps an unsurprising response from a satellite operator. But Oudendijk points out that pretty much every area of Astra’s business is growing. In 2009, it broadcast to 125 million TV homes across Europe and North Africa – three million more than the previous year. “We expect that the launch of new channels, and the market entry or expansion of pan-regional pay-TV operators will lead to positive growth rates again this year,” says Oudendijk.

SES is currently in the middle of a substantive investment programme. It has 12 satellites under construction, which will give it a net increase of 300 transponders by 2014, likely to bring E400m of new annual revenues in 2015. One of the main growth drivers, says Oudendijk, is HD TV. Astra currently broadcasts 120 HD channels to six million HD homes. “We expect the number of HD channels and viewing homes to increase significantly over the coming months,” says Oudendijk. Last November the operator launched a HD service for the German market, HD Plus, which broadcasts from the orbital position at 19.2° East. By February over 600,000 smart cards had been ordered by set-top manufacturers. 3D will also offer a growth path, says Oudendijk: “3D TV represents the next big thing in television. Our satellites are ready to broadcast a broad range of 3D content. The next step will need content providers to develop sustainable business models. We expect the pay-TV operators to play a pioneering role here.”

Triple-play

While satellite operators, including Astra, will continue to see growth from core TV services, the convergence of services offered by all pay-TV operators – led by telcos and cablers – has seen them attempting to tap into the triple-play space. Astra and Eutelsat have both launched broadband-via-satellite services, and can deliver TV, internet and VoIP to households using the same delivery mechanism. “With our satellite-based broadband access, ASTRA2Connect, we already offer triple-play services via satellite,” says Oudendijk. ASTRA2Connect offers speeds of up to 4Mbps – VoIP telephony services as well as analogue and digital TV reception (with a second LNB) can be added. Since launching in 2007, the service now has more than 60,000 end customers, and Oudendijk is convinced that it is a viable mass-market product. “Terrestrial broadband networks are indeed expanding and telco operators are offering their customers increasingly fast lines. Nevertheless, this expansion is mainly restricted to the metropolitan areas – the deployment of super-fast broadband is simply not profitable for rural areas. Today, a number part of households in rural Europe are not connected to terrestrial broadband – and probably never will be.”

“3D represents the next big thing in television. Our satellites are ready to broadcast a broad range of 3D content.”

Alexander Oudendijk, SES Astra

Eutelsat’s consumer satellite-broadband product Tooway had 58 distributors in 26 countries at the end of 2009, including French telecommunications group SFR, Telecom Italia and Swisscom. Currently operating in Ku- and Ka-band from Eurobird 3 and Hot Bird 6 respectively, Eutelsat plans to launch its first satellite operating exclusively in Ka-band frequencies that will “deliver a cost per bit that will be significantly lower than regular Ku-band satellite,” according to CEO Michel de Rosen. Eutelsat expects to launch KA-SAT between November 2010 and January 2011, with the satellite operational by the end of the first quarter. “We believe the broadband market has major potential for growth going forward,” says de Rosen, adding that the company is not trying to compete with fibre or ADSL competitors. Satellite broadband will be most successful in sparsely populated areas, he says. “With the KA-SAT programme we are building a highly efficient infrastructure for the significant addressable market of homes in Europe and the Mediterranean Basin beyond the range of terrestrial broadband.” The problem of digital exclusion will be exacerbated by the emergence of fibre in densely populated areas, he says. Whereas, France, for example, has high ADSL penetration of 98%, it is estimated that up to 30% of the population in areas with low population density will be beyond fibre. “This makes wireless technologies, notably satellite, core to complementing terrestrial.”

While broadband services continue to grow, the bulk of Eutelsat’s business remains in video – 72% of revenues come from broadcast services. The operator has defied the economic crisis and continues to post impressive results – so much so that it raised its 2009-2010 financial targets earlier this year on the back of strong revenue growth in the first half of the year. The company has registered strong growth in newer markets, including in Russia, the Middle East and Africa – recently signing a deal to broadcast the new Zon Multimédia-backed DTH service for Angola, Zap, using five transponders on the southern African beam of the W7 satellite, for example. “In the medium to long-term, bandwidth-hungry video applications that are both broadcast and consumer-generated are at the centre of a digital revolution that is transforming television and broadband networks and impacting positively on the satellite sector,” says de Rosen. Eutelsat already broadcasts over 100 HD TV channels and it saw a 37% increase in the number of HD channels broadcast last year. The operator remains cautious on HD revenues, however. “We have not put in big figures for HD increment [in the July 2009-2012 guidance],” says de Rosen. “If there is a big boost it will be an upside for us.”

“We are building an infrastructure for the significant addressable market of homes beyond range of terrestrial broadband.”

Michel de Rosen, Eutelsat

Eutelsat is also gearing up for the future of 3D TV, with a dedicated all-3D channel on Eurobird 9A. It has already broadcast live footage of a Six Nations rugby match between France and England in 3D to 30 cinemas in France and more recently a sequence of classical ballet performances from St Petersburg to 3D TV sets in Moscow and Paris. It has also signed a deal with Russia’s General Satellite Corporation, which will add up to 500 hours of 3D content to Eutelsat’s channel. “In terms of where we see potential for growth [for 3D], as is already the case with HD, we anticipate the emergence of 3D in both western and eastern Europe,” says de Rosen. “We are fully-equipped to respond to both types of 3D market. The first, which is already fully now validated, is the commercial offer of out-of-home live events broadcast to cinemas, theatres and other public venues. The scalability of a satellite network is a strong asset in this market as a dish and an HD set-top-box are all that is needed to deliver unsurpassed video and audio quality even to the most remote areas located way beyond beyond high-capacity terrestrial networks. The second market is 3D in the home which is emerging as a premium option proposed first by satellite pay-TV platforms. This new broadcast option, coupled with new generation 3D-compatible Blu-Ray players will stimulate the domestic market.”

Eutelsat has set itself a steady expansion goal. After adding four new satellites to its line-up last year, it has expanded the available capacity to 650 transponders and with a further four satellites due to launch by the end of 2011, capacity will grow further. By the end of December 2009, 532 transponders were being leased out, an increase of 8.8% year-on-year and the operator seems confident that capacity demands will continue to grow. The number of channels broadcast from its established Hot Bird neighbourhood at 13° East stood at 1,079 as of February 2010, a rise of 6% despite no new satellites becoming operational at that location during 2009. Compare this to the relatively new neighbourhood at 9° East, which covers mainly central and eastern Europe. The commercialisation of Eurobird 9A at this location last year led to the number of channels broadcast from here increasing by 77% to 263.

Global expansion

Global expansion

Israel-based operator Spacecom says it is in the process of transforming itself from a regional player into a global satellite provider, with the African and Asian markets being of particular interest. It is carrying out an ambitious growth plan that has seen a new satellite, Amos-5i, serving Africa since going operational from 17° East in January and has Amos 4 scheduled for launch next year, to cover Asia. “We believe the markets we have chosen to focus on, our traditional markets in the Middle East and central eastern Europe, as well as the emerging markets we have started penetrating in Africa and Asia, are growth markets,” says Motty Slomovitz, vice-president of marketing and sales US. “Demand for capacity is growing around the world and with greater penetration of telephony and broadband internet in developing and developed markets, our fleet will provide services in the right spot for the right period.”

Slomovitz believes DTH operators are increasingly looking to expand their service offerings beyond the core delivery of TV into wider communications. The transition into triple-play operators gives satellite operators the chance to enhance the services they provide, which, says Slomovitz, can only be a good thing for the satellite industry. “As DTH operators take advantage of trends in communications to beef up their service offerings, we are seeing them combine satellite with broadband internet, telephony, IPTV and mobile services,” he says. “We see these combinations as complementary to our business. You must remember that as service offerings grow, transportation methods merge or combine to make communication more effective and all encompassing and this is good news for the AMOS constellation, as well as for the industry.”

[icitspot id=”9387″ template=”box-story”]

Next up for Spacecom is the launch of AMOS-5, scheduled for next near – “a much larger and stronger” satellite to replace Amos 5i, according to Slomovitz, for which Spacecom has already secured several long-term pre-launch deals. The following year will see the launch of Amos 4 into an as yet unconfirmed orbital slot over Asia. Beyond that, the operator is already planning for a future of advanced services. As well the company’s projected growth of DTH, particularly in Africa, “we are also looking at the satellite broadband market for growth, as well as a complementary solutions for DTH operators to provide a satellite-based triple-play offering,” says Slomovitz. “In fact, this will be one of the main target markets for our new Amos-6 satellite programme that is currently in the design phases.” The operator is planning a 2013 launch for the satellite, which will likely join Amos-2 and Amos-3 at the 4° West slot.

Telenor Satellite Broadcasting (TSBc), based in the Nordic region, says its presence in central and eastern Europe is growing thanks to the expanding amount of capacity at the 1° West location. Here, it owns and operates three satellites – the soon to be retired Thor III, Thor 5 and Thor 6, which, along with capacity on Intelsat’s 10-02 satellite, broadcasts over 250 channels. According to CEO, Cato Halsaa, despite challenging economic conditions, capacity demand in the region has remained high. “We have experienced strong growth – the prime drivers have been existing customers adding HD TV and UPC, who will shortly begin transmitting from 1 West.” However, he adds, there has been some impact from the recession and he senses that some projects may have been delayed. UPC Direct, the European DTH arm of Liberty Global agreed last year to lease an initial seven transponders on Thor 5 and Thor 6.

Telenor introduced two new satellites into commercial service in the last two years, the latest being Thor 6, which went into operation last December. It is fitted with 16 Ku transponders for coverage of the Nordic countries and a further 20 transponders targeting the growing central and eastern Europe market. “These satellites have had the dual role providing both replacement capacity and growth capabilities in the target markets,” says Halsaa. “We are currently considering how best to provide more growth capacity, taking into account both market developments and technical change.”

The number of HD channels broadcast from 1° West has grown significantly and includes Animal Planet HD, BBC HD and Eurosport HD among others. The growth trend will continue says Halsaa: “HD is currently a significant catalyst for growth for satellite operators, and we would expect this to continue as HD channels proliferate and more regional and local content emerges.” While the provision of satellite capacity for DTH services will continue to be a “key element” of TSBc’s business, the company is continuing to develop teleport services including encoding, multiplexing and uplinking, says Halsaa. “Additionally we operate a centralised head-end which delivers content for the DTT network, and provide technical services for IPTV delivery and VOD platforms. A fibre network providing connectivity between our operational sites supports this.” TSBc also has a portfolio of occasional use and data communication services, he adds.

The number of HD channels broadcast from 1° West has grown significantly and includes Animal Planet HD, BBC HD and Eurosport HD among others. The growth trend will continue says Halsaa: “HD is currently a significant catalyst for growth for satellite operators, and we would expect this to continue as HD channels proliferate and more regional and local content emerges.” While the provision of satellite capacity for DTH services will continue to be a “key element” of TSBc’s business, the company is continuing to develop teleport services including encoding, multiplexing and uplinking, says Halsaa. “Additionally we operate a centralised head-end which delivers content for the DTT network, and provide technical services for IPTV delivery and VOD platforms. A fibre network providing connectivity between our operational sites supports this.” TSBc also has a portfolio of occasional use and data communication services, he adds.

Russia and beyond

Russian operator RSCC is another company with ambitious growth plans, with eight satellites scheduled to launch by the end of 2013. At present, the operator broadcasts 410 TV and radio channels, but the demand coming from broadcasters “is much higher than RSCC’s current capabilities”, says Ksenya Drozdova, RSCC’s deputy director general and head of business development, who suggests that capacity shortages could be running at up to 13%. The digitisation of the Russian pay-TV market is underway and RSCC predicts that about 90 transponders will be needed to meet the growing demand for digital TV services in Russia by 2012. Two satellites will be launched in 2012 – Express AT1 and Express AT2. Drozdova says the company’s launch plan will enable the operator to “meet the requirements of the market and create the potential for further DTH service development.”

“HD is a significant catalyst for growth for satellite operators, and we would expect this to continue as HD channels proliferate.”

Cato Halsaa, Telenor

HD services have been slower to roll out in Russia that in Western Europe, which Drozdova suggests is in part down to the lack of capacity. “HD is a very promising service, although it is not so widely spread in Russia as in western Europe. As far as we know, several companies have plans for new satellite HD channels. Here we are faced again with the capacity shortage that slows down the HD service development. We are certain that HD TV will grow rapidly, especially after the launch of Express-AM4, AM5 and AM6 [scheduled for launch between 2011 and 2012].”

RSCC is one of many operators expanding their presence in the DTH space in response to capacity demands. The question remains whether there’s enough room to accommodate so many global, multi-service parties. Judging by the robustness of the DTH and wider satellite industries, the sky’s the limit.