US SVOD revenues to stall as country approaches peak streaming

The US is potentially reaching peak SVOD profitability, a new report has found.

According to Digital TV Research’s latest examination of the US DTC market, US SVOD revenues will grow by US$43 billion in 2021 to US$56 billion in 2024. However, the report notes that following this expansion, growth will almost be flat from 2024 through to 2027, the end of the reporting period.

The report highlights that price competition combined with lower ARPUs from hybrid AVOD-SVOD products will result in stagnant growth.

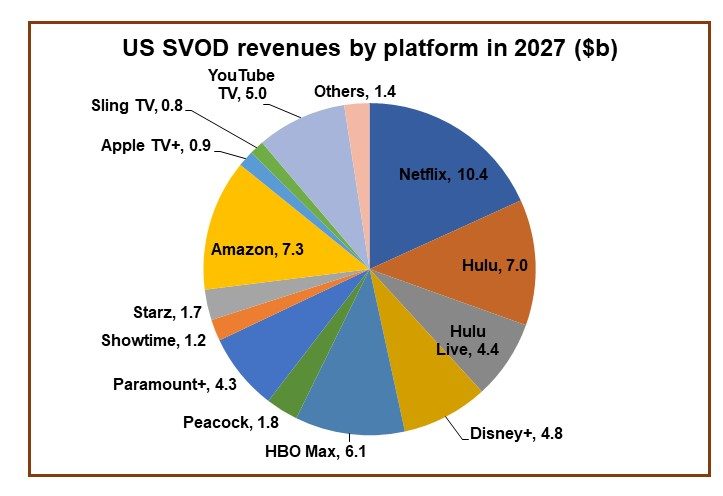

By 2027, Netflix will be generating US$10.4 billion per year in the US to be the single largest player. Disney will be the largest company overall, with Disney+, Hulu and Hulu Live generating a combined total of more than US$16 billion in US revenues. Amazon will be at US$7.3 billion for SVOD revenues, while HBO Max will be at US$6.1 billion (though it is unclear in what form the streamer will be as cost-cutting at Warner Bros. Discovery continues to decimate HBO Max’s library and good will) and Paramount+ will be firmly placed in fourth with revenues of US$4.3 billion.

The report also estimates that Netflix will have 63 million subscribers by 2027 – down by 4 million from 2021. Hulu, Disney+, HBO and Paramount+ will each have between 40-50 million subscribers by 2027.

Simon Murray, Principal Analyst at Digital TV Research, said: “Netflix will remain the SVOD revenue winner. However, the platform will lose $1.4 billion in SVOD revenues between 2022 and 2027 due to lower ARPUs from 2023. Netflix will more than recoup these SVOD revenue losses with AVOD sales.”