eMarketer: US TV ad spend to continue to fall

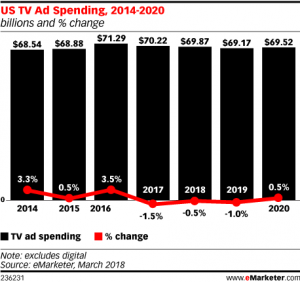

The acceleration of ‘cord cutting’ and rise of over-the-top (OTT) viewing will see TV advertising spend drop 0.5% in the US this year to US$69.87 billion – with this expected to sink further in the coming years.

This is according to new eMarketer research, which claims that TV’s share of total US media expenditure will drop from 33.9% in 2017 to 31.6% this year.

This is according to new eMarketer research, which claims that TV’s share of total US media expenditure will drop from 33.9% in 2017 to 31.6% this year.

By 2020, eMarketer expects TV to drop to less than a quarter of total US ad spend, despite a “slight uptick” in 2020 due to the next US presidential election and the Tokyo Olympic Games.

“The shift of audiences to OTT viewing is changing the climate of the TV ad market,” said eMarketer senior forecasting director Monica Peart. “As ratings for TV programming continue to decline, advertiser spending will also continue to see declines, especially in years that do not boast major events such as presidential elections and Olympic games.”

eMarketer said it expects cord-cutting to continue to gain momentum in the US, with the number of TV viewers tipped to drop 0.2% to 297.7 million this year and the number of OTT viewers expected to grow 2.7% to reach 198.6 million.

According to the report, OTT platforms account for a “small but growing share” of the digital ad market, which will climb 18.7% overall this year to US$107.3 billion.

Roku’s US ad revenues are expected to climb 93.0% this year to surpass US$293 million, while Hulu’s US ad revenues are tipped to increase by more than 13% to reach US$1.12 billion.

“Over-the-top platforms are growing in number and size, and many compete directly with pay TV by offering bundles of live channels at attractive price points,” said eMarketer principal analyst Paul Verna.

“Consumers who want to cut or shave the cord now have a wealth of options that didn’t exist a couple of years ago. And we expect the offerings to become even more robust as more players enter the market.”