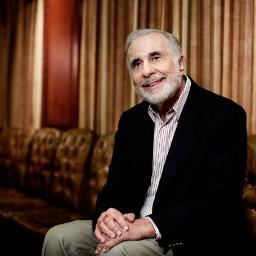

Carl Icahn sells Netflix shares for bumper US$819 million

Billionaire investor Carl Icahn has sold more than half of his shares in streaming site Netflix in deals that have pocketed him more than US$800 million (€584 million).

According to an SEC filing issued yesterday, Icahn sold 2.98 million shares – around 5.1% of his 9.4% stake – over 12 days beginning October 10. The deals are worth a cumulative US$819 million, representing a 457% gain on the US$58 a share price he paid for 5.54 million shares just 14 months ago.

Icahn – an activist investor who has memorably clashed with the likes of Jon Feltheimer at Lionsgate – said that “when you are lucky and/or smart enough to have made a total return of 457 per cent in only 14 months it is time to take some of the chips off the table”.

“I want to thank [CEO] Reed Hastings, [chief content officer] Ted Sarandos and the rest of the Netflix team for a job well done. And last but not least, I wish to thank Kevin Spacey [star of Netflix original House of Cards],” he added in the filing.

Netflix this week affirmed it was planning to double spend on originals and had moved past 40 million global subscribers.

Icahn Enterprises retains a 4.5% share in the company and said in a press release it believed the streaming service was still “undervalued”. It would be “reasonable” to expect Netflix subscription price point of US$7.99 a month to increase to US$9.99 over the next five years, the filing claimed.

Furthermore, even with expenditure set to rise by as much as US$1 billion annually as Netflix moves further into originals, “the [company’s] operating leverage would still be impressive, adding US$3.3 billion to domestic contribution profit”.

Icahn also predicted that international growth would drive Netflix’s growth going forward. “Because Netflix launches its product in each territory with a robust service, it must spend on the completion of this product, and the marketing of it, in advance of signing up new subscribers, which is why we expect the international segment to continue losing money in the near term.

“However, as these international markets mature, we expect that the aggregate international operating profits will actually exceed the domestic.