European connected TV ad market set for growth with UK leading

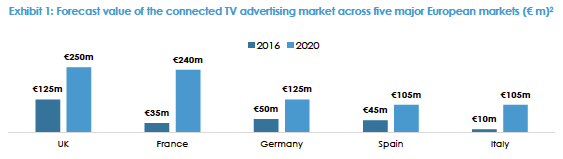

The European connected TV advertising market could be worth €825 million by 2020, according to research commissioned by ad technology specialist SpotX.

The UK is Europe’s market leader in connected TV advertising, with €125 million’s worth of advertising being viewed on a TV connected to the open internet via streaming devices, smart TVs, games consoles and set-top boxes in 2016, according to the research commissioned by SpotX from MTM. The connected TV advertising market in the UK is expected to grow to €250 million by 2020.

The UK is Europe’s market leader in connected TV advertising, with €125 million’s worth of advertising being viewed on a TV connected to the open internet via streaming devices, smart TVs, games consoles and set-top boxes in 2016, according to the research commissioned by SpotX from MTM. The connected TV advertising market in the UK is expected to grow to €250 million by 2020.

France will see the greatest growth in connected advertising amont the five major markets considered by MTM, with connected TV advertising growing from €35 million last year to €240 million by 2020. The German connected TV market will grow from €50 million to €125 million. The Spanish connected TV market, which totaled €45 millino last year, will grow to €105 million, while the Italian market will grow from €10 million to €105 million.

According to MTM’s analysis, based on interviews with broadcasters and industry experts, participants in all five countries believe that ad-supported OTT services from broadcasters will increase their share of OTT viewing, as awareness of their services grows, relative to ad-free services such as Netflix, increasing the potential for connected TV advertising..

Rising sales of Amazon’s Fire TV stick in particular was cited as a driver for increased viewing of OTT video on TV screens rather than other devices in both the UK and Germany..

On the downside, participants in the survey believe that existing TV audience measurement panels are not yet fully capturing OTT video viewing alongside broadcast TV. For example, in the UK, BARB’s panel captures viewing of broadcaster content on connected TV services and via traditional TV, but does not distinguish between the two.

In all markets, participants believe total audience measurement – combining TV and digital audience measurement – is crucial for the CTV ad market to develop. There are some signs of improvement, with Mediamétrie launching an advances system last year and BARB and Italy’s Auditel set to follow suit next year.

Participants in all markets expect broadcasters to face significant competition in the CTV advertising market from Facebook and Google, and estimate that these companies could capture between a third and a half of the future CTV advertising market in each country, if broadcasters do not compete aggressively. In the longer term, many participants also feel that Amazon and potentially Netflix will look to introduce advertising into their services.