Replacement TV set sales to drive industry growth

Replacement flat panel TV sales will help to inject “renewed growth into global TV sales” over the coming five years, according to new research by Strategy Analytics.

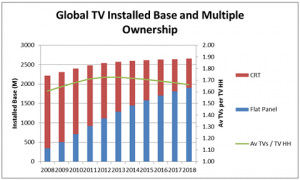

The Global TV Replacement and Ownership 2008 – 2018 report claims that roughly 23% of global flat panel TV sales in 2013 were bought as a replacement for an existing flat panel display and that this share will grow to 67% by 2018.

Strategy Analytics predicted that this would help drive a 3.8% growth in the compound annual growth rate of TV shipments over the same period.

“We are now witnessing the first major wave of Flat Panel TV replacement particularly in developed markets such as Western Europe and North America,” said David Watkins, Strategy Analytics’ service director of connected home devices.

The research claims that the number of global TV households will grow from 1.49 billion to 1.60 billion or 85% of total global homes by 2018. However, it added that the global average number of active TVs per TV household peaked in 2013 at 1.72 and will fall to 1.66 by 2018.

Eric Smith, Strategy Analytics analyst for connected home devices said: “Moving forwards the TV industry will become less reliant on consumers purchasing additional sets for their homes as alternative TV viewing devices such as tablets will increasingly impact on demand for small screen TVs that would be destined for use in a bedroom or kitchen. Replacement demand for the main living room TV set will become the major driver of TV sales over the next 5 years”.

Separately, Strategy Analytics said that Samsung TV shipments grew by 16% in the first half of 2014 driven by demand generated by the World Cup in Brazil. Average selling prices for Samsung TVs also fell 13% in the first half of 2014 compared to the previous year.